As the world continues its battle with coronavirus and the uncertainty that lies ahead, there are lights beginning to flicker at the end of the tunnel.

If you’ve taken any of your social distance to focus on sharpening your economics knowledge, you’ve probably read about how the economic shock caused by this pandemic is both a demand shock (people aren’t buying as much) and a supply shock (factories are closed to slow transmission).

By looking at China, where the onset of the outbreak happened much earlier, we get a glimpse of how things could play out for the rest of the world. China took very aggressive quarantine measures and for the last month their cases have leveled off at around 80,000 infections. Now that quarantines are being lifted and people are going back to work, economic data is beginning to show a rebound in supply-side activity.

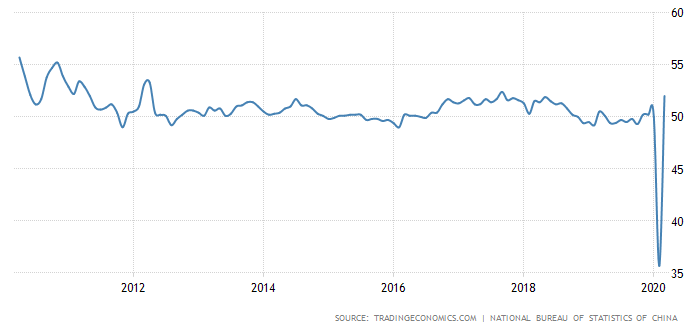

China’s manufacturing index was released yesterday for March and easily beat market expectations after posting its strongest pace of growth since September 2017 as factories began to re-open. The NBS cautioned that the readings may not signal a stabilization in economic activity, but business sentiment is also on the rise.

China NBS Manufacturing PMI

Investors looking at China are now less focused on the supply-shock, and have shifted their focus to seeing how fast and where consumer demand rebounds. At home they are doing this through local government stimulus programs that put cash in the hands of lower income consumers who they hope will engage in “revenge buying” to make up for all of their lost purchases during their lockdown. In the city of Wuhan, where this global pandemic started, 85% of business are back up and running. The main concern for China’s economy at this point is the “second wave” where demand for Chinese exports is low because the rest of the world is now on lockdown even though Chinese factories are opening back up.

Another glimmer of hope comes from the fact that global growth in new cases discovered was below 10% for the last two days after exceeding that for much of the last two weeks. President Trump has warned that the next couple of weeks are expected to bring many more cases to the U.S. and that social distancing measures should be taken seriously if we hope to #FlattenTheCurve. Voting members of the FED pointed out that it’s hard to determine the economic impact of the virus when we still don’t know the course it will take. The more steps we take to tamp down transmission, the more quickly the economy will be able to bounce back. Either way, the FED has shown a willingness to pull out all of the stops both from a liquidity standpoint (to make sure markets are able to operate relatively smoothly) and from a stimulus point (by driving interest rates to zero to generate more economic activity).