Hurry up and wait.

For weeks we’ve talked about how large turnout via mail-in voting would likely delay the time between when the polls closed and when the votes are tallied.

Here we are – don’t be surprised or anxious. We knew this was going to happen.

As we’ve seen COVID-19 politicized throughout 2020, it’s no surprise that a higher percentage of in-person votes yesterday were for GOP candidates. Biden is expected to make up ground in key states like Michigan and Pennsylvania as mail-in votes are added to the totals. TV pundits repeatedly reminded us that we might have to wait until Friday to project winners in these states as ballots postmarked by election day are valid votes (whether Trump likes it or not.)

While some were hoping for upsets in Texas, Ohio or Florida to seal the deal early on last night, the electoral college map is strikingly similar to that of 2016 with the exception of Arizona and Nebraska’s 2nd Congressional District (where a departure from the “winner-take-all” electoral college methodology may afford Biden a tie-breaker).

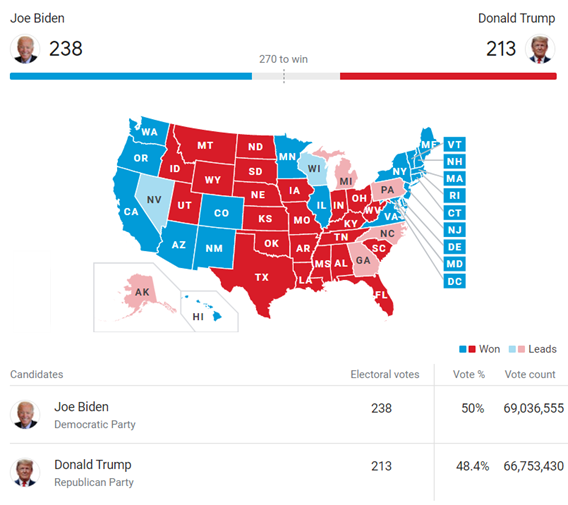

Here’s where we stand currently:

As we stop and digest the decisions of the U.S. electorate and how they’ll shape the political landscape for the next 2-4 years, the Federal Reserve will continue pushing forward. They will convene for the November FOMC meeting today and tomorrow where they will pour over economic data to determine the correct monetary policy actions to put the American economy on track to a brighter future.

In a year of political strife and gridlock, Jerome Powell and his band of economists have reliably added stimulus to the markets to boost liquidity and shore up investor confidence. While the central bank places a focus remaining apolitical, they are standing by in case confidence is shattered by a contested election.

Some investors are also expecting the FED to add to its monetary stimulus via an increase in its bond purchasing program, especially as the lack of political decisiveness has continued to stall fiscal stimulus that would help the U.S. labor market and U.S. consumers bridge the gap through this economic downturn. Europe, Canada and Australia have all gotten a bit more dovish (more stimulus) as COVID cases have increased causing lockdowns in countries like Germany and France.

Amidst all the uncertainty that we’re faced with, have faith in the future because Reason Will Prevail!