As we all wrap up 2020 and start setting goals and expectations for 2021, the Federal Reserve is no exception.

Today concludes the Federal Reserve’s last meeting of 2020 – this is their 10th FOMC meeting of the year.

They typically meet 8 times in a year – Even in 2007/2008 and the aftermath of the market meltdown, the group did not have extra meetings.

At 2 PM, the group will publish their announcement and then Chairman Powell will provide commentary during his press conference at 2:30. Traders and other economists will hang on to every word and then base their expectations and trades for 2021 on the FED’s outlook.

Why the extra meetings?

These two extra meetings took place on March 3rd and March 15th at a time when COVID-19 was becoming less of a “corona-beer” meme and more of an economic and health crisis reality for the United States.

The FED stepped in with swift action to calm markets and backstop the economy, while Congress worked on the CARES legislation that would fiscally support workers and consumers in the U.S.

- March 3rd – FED cut rates by 50 bps to target range of 1-1.25%

- March 15th – FED cut rates by 100 bps to target range of 0-0.25%

FED announces bond buying stimulus of at least $700 billion

The FED is currently purchasing $120 billion of treasury bonds and mortgage backed securities each month and markets are looking to understand exactly how long the FED will continue this form of monetary stimulus to keep rates low.

There is more chatter from the hill about how Pelosi and McConnell are closer to a deal on new fiscal stimulus package to help American’s bridge the gap until vaccines are distributed and effective at allowing full re-opening. We continue to wait and see when/if/how congress will act.

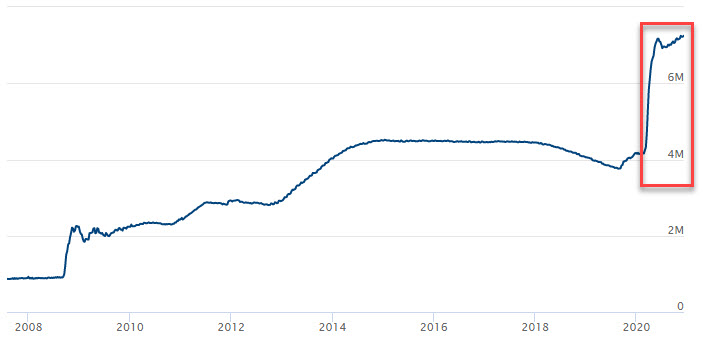

Total Assets of the Federal Reserve

The FED’s most recently published economic projections show the group expecting the economy to grow 4% next year and unemployment to drop to 5.5%. Traders are waiting for the updated forecasts, but as today’s retail sales report showed consumption slowing down with a 1.1% drop MoM in November, it looks like more support is needed to support the economic recovery.

Retail Sales of automobiles fell even further in November (~1.5%) after seeing a recovery in September. As the chart from Experian shows below, the Auto market saw a strong “V-shaped” recovery in the 6 months following the initial drop, but without stimulus checks flowing, and fewer commutes being driven there is still uncertainty on the horizon.

Plus, with fewer new vehicles purchased in 2020, this could lead to a smaller supply of used vehicles on the market in 3-5 which would effectively boost prices and demand for new cars – unless self-driving cars get here first and people switch to a Tesla/Uber/Waymo subscription.