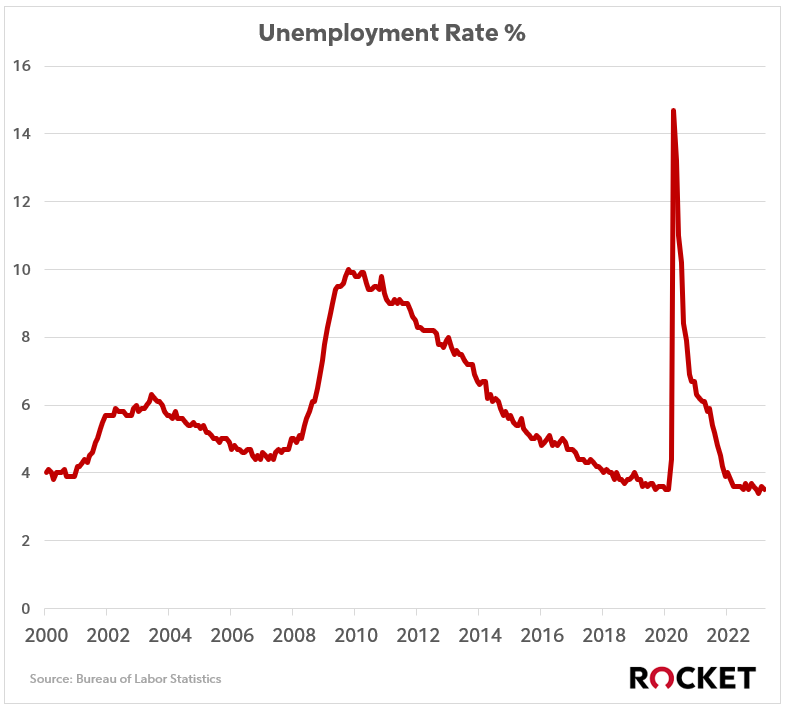

As the Fed has continued to fight the good fight against inflation by raising interest rates, they’ve had to keep an eye on the other part of their dual mandate from Congress – full employment.

With the unemployment rate holding below the long-term average at 3.5%, some might say this challenge the narrative of an impending recession.

It’s not just whether people have jobs that drives recessions, it’s whether consumers are spending, since ~70% of the total output (GDP) of the U.S. economy stems from consumer spending.

While consumers have continued their spending spree beyond what many economists had originally projected, they’ve had to level up their credit cards to do so – so there’s a limit.

Last week’s retail sales report showed a 1% drop in consumption month-over-month while consumer sentiment ticked up slightly. However, more consumers in this survey were concerned about inflation.

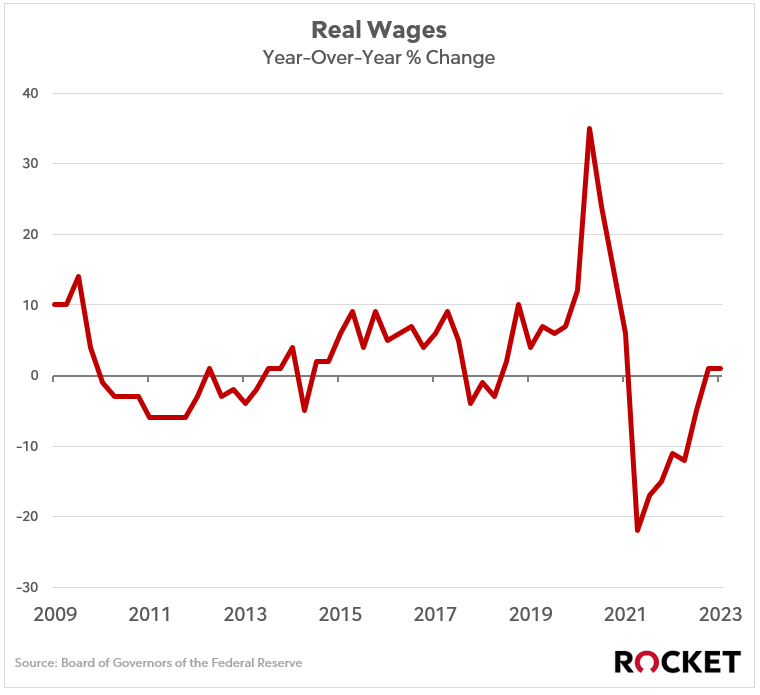

Here’s the good news for them:

Real wages (a.k.a. wages adjusted for inflation) are up year-over-year after declining for the previous two years.

Some thought the Fed would hold off on additional 0.25% rate hikes due to the banking crisis and recession narratives.

However, this employment/consumption indicator may give the Fed confidence that they can keep rates higher to root out inflation.