Looking for a new hobby during this shelter in place? Some people are baking banana bread and playing barista, but why not try oil storage?

Have some extra space in the garage or a few rain barrels you don’t need? With oil futures plummeting to an all-time low yesterday, they found their way in negative territory for the first time at -$37 a barrel. This means investors can either hold their oil in storage until prices rebound, or pay buyers to take delivery. Futures contracts turn positive later in the year [$31 / barrel in OCT] (aligned with the expectation that global demand will rebound in the second half of the year when lockdown restrictions loosen) and investors are looking for creative ways to store their crude until then including in “Very Large Crude Carrier” ships where storage costs are up 300%.

Speaking of ships, U.S. companies are looking for safe harbor. Major lobbying groups are asking Congress to pass measures to protect companies from lawsuits related to the virus once states begin lifting shelter-in-place restrictions. The industry groups are looking to protect and curb liabilities for employers who follow official health and safety guidelines. In addition they are looking for legal protection in wages, hours, leave and travel disputes that may result from the virus.

These lawsuits may start to develop as three states are already loosening their restrictions this week – South Carolina, Georgia and Colorado. These states open up as Trump admitted last week that states are allowed to control their own destiny, but as many of his supporters showed up in state capitols protesting the shutdowns. The government continues to walk the line between public health and the health of the economy and health experts maintain that a premature re-opening could bring a second wave of the virus which would in turn likely require more shutdowns to stem.

New York Governor Andrew Cuomo was adamant that testing needs to get up to scale before reopening the economy. Recent testing in Los Angeles may indicate that Cuomo is on to something, as 4.1% of participants in the study tested positive for Coronavirus antibodies suggesting that the rate of infection may be 40 times higher than the “confirmed cases” number. This would mean that the death rate is lower than previously projected, but that the disease is being spread widely by people showing mild or no symptoms.

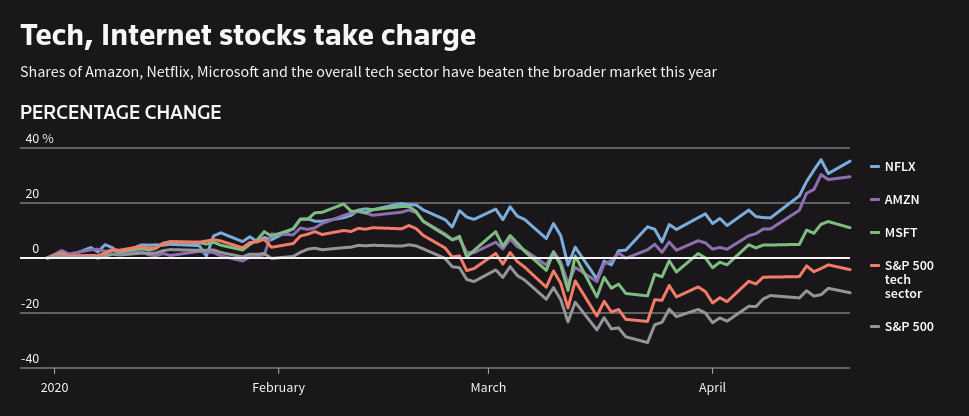

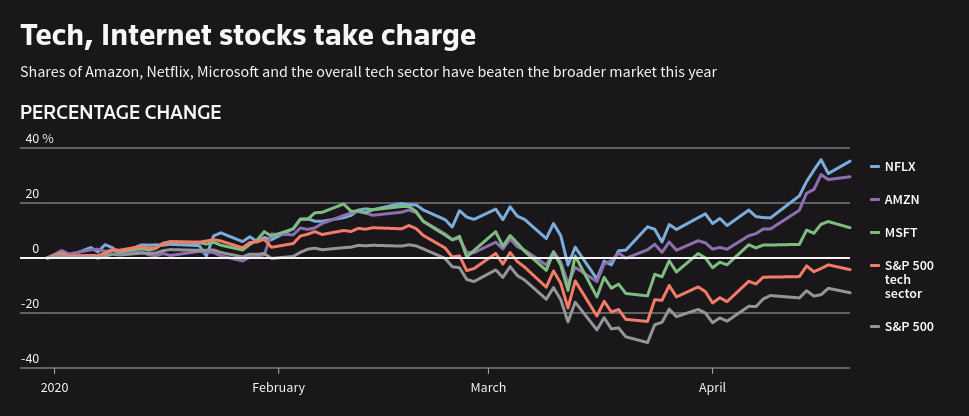

As investors “buy the dip” throughout this economic shock, some look at cruises, air travel and oil to give them a big payday, looking at the significant drop thus far and assuming they will return to former glory. Others are looking at technology stocks whose business models’ are somewhat immune to the virus and some (like Amazon/Netflix/Microsoft) even grow because of the virus (due to a change in consumer behavior). Further still, some investors are choosing these tech stocks because their cash/brand position will allow them to weather the storm. This has resulted in Microsoft, Apple, Amazon, Google and Facebook accounting for more than 20% of the total market capitalization in the S&P 500 index. According to Bank of America, that’s a greater concentration in the top stocks than was seen during the dotcom bubble of 2000.