Safety First!

As we edge closer to the 2020 elections, candidates are looking to do anything they can to fuel their narrative and drive voter turnout in their favor. At the top of the ticket, Americans are looking for a President who will solve problems, namely the ones stemming from the spread of COVID-19.

According to a Gallup poll released earlier this year, the Coronavirus was flagged as the most important problem facing the U.S . with 45% of surveyed U.S. adults focusing specifically on the virus rather than the economy in general. A refreshed poll from last month shows only 30% are currently labeling COVID as the top issue, however, concern for “Race Relations/Racism” has grown 15% in the same time period which wouldn’t indicate a drawback in concern over the virus. In the same time, “The Government/Poor Leadership” has continued to grow as a top issue.

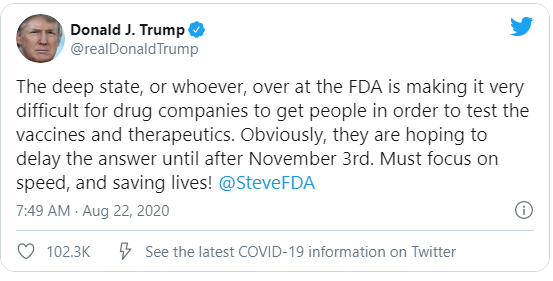

President Trump has been spreading his wishful thinking that a vaccine will be ready for distribution before election day even though top experts like Anthony Fauci are looking towards early 2021. Trump seems hopeful that he can tweet it into existence sooner.

Last month, Russia released “Sputnik V” – a COVID vaccine that Putin was excited to use in demonstrating the power and might. Amid concerns from the scientific and healthcare community, Putin emphasized that the vaccine was safe and that even one of his daughters had been given a dose. However, only 24% of a survey of 3,000+ doctors said they would administer this vaccine to their patients and trade unions representing doctors and teachers have recommended that their members steer clear of this vaccine.

After Russia’s release, and the FDA head saying that vaccines might not need Phase 3 clinical trials (where safety and efficacy are typically demonstrated), the World Health Organization was quick to call for caution. Experts are concerned that rolling out vaccines too quickly poses both direct risks to health as well as long term impacts on acceptance and confidence in vaccines.

As U.K. drugmaker AstraZeneca put their leading Phase 2/3 trial on hold yesterday due to an unexpected illness from one of their test subjects, investors moved money from stocks into bonds as the outlook worsened for how quickly we might be able to produce and distribute a vaccine that would help jumpstart the economy.

Even with all the political pressure, sanity is prevailing, and nine leading U.S./European vaccine developers pledged yesterday to uphold scientific safety and efficacy standards for their experimental vaccines despite the urgency to contain the pandemic.

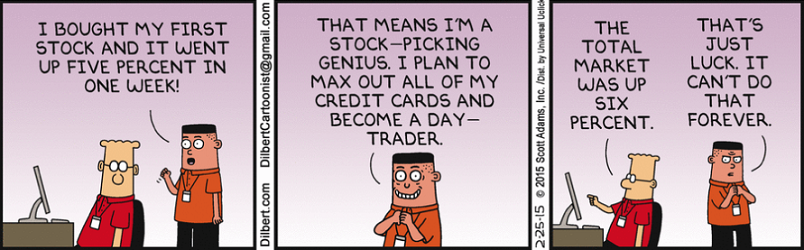

If you recently started your career as a Robinhood day trader – here’s what some folks are saying about the recent stock selloff:

“Some froth has come off the market which is a good thing, but keep in mind that we still remain well over levels that could be considered ‘fair value’ in stocks,”

“And while the outlook for stocks remains generally constructive long term, there’s a lot more downside in this market if we get any major disappointments.”

-Tom Essaye, The Sevens Report

“A setback like that seen in Nasdaq stocks over the past days has been overdue,”

“Nonetheless, the underlying drivers of the recent rally remain in place. We believe that the recent setback will emerge as a buying opportunity for year-end performance.”

– Alexander Kraeme, Commerzbank AG

Meanwhile, Jerome Powell and the FED are giving themselves some wiggle room with their words:

“We are not tying ourselves to a particular mathematical formula that defines the average,”

“Our decisions about appropriate monetary policy will continue to reflect a broad array of considerations.”