According to the consumer research firm Nielsen, U.S. sales of mints are down 30% YoY at stores with gum following closely behind down 28%.

Don’t worry, there isn’t concern of a wide spread pandemic of bad breath, though, as toothpaste and mouth wash sales are up ~12% in the same time period.

In fact, it’s likely beneficial for public health to see consumer behavior changing to more foundational dental care rather than cosmetic coverups – perhaps the cleaning cancellation notices from dentist offices across the nation without indications of when they’ll be rescheduled is causing people to take a second look at how they care for their pearly whites.

Consumer behavior is at the top of every elected official and CEO’s mind these days as they imagine the social and cultural changes that could occur from a long term lock down and how to shift their business or government accordingly. Also at the top of this list is the behavior of American workers. According to a study by the University of Chicago, roughly two thirds of unemployed workers are receiving more in unemployment benefits than they received in compensation prior to the pandemic. Some at the FED are saying that this is making it more difficult for small businesses to regain their footing as they now have to increase payrolls to convince workers to come back.

The FED’s Beige Book release yesterday gave an anecdotal look into the 12 districts of the Federal Reserve system to give a more current understanding of where we’re at as we wait for hard data to roll in.

“Economic activity declined in all districts – falling sharply in most”

“Although many contacts expressed hope that overall activity would pick up as businesses reopened, the outlook remained highly uncertain and most contacts were pessimistic about the potential pace of recovery.”

“Contacts cited challenges in bringing employees back to work, including workers’ health concerns, limited access to childcare and generous unemployment insurance benefits.

FED Beige Book – May 27, 2020

Today brings more employment data with another round of initial jobless claims expected to come in at 3.3 million bringing to total to 40+ million over the last 10 weeks. While this is the number quoted in headlines across the media networks, economists caution that due to technical and procedural issues at state unemployment offices this number is over-inflated.

Instead, economists say the number to watch is “continuing claims”, which reported on a one-week lag are expected to grow from ~25 to 25.7 million this week. This gives a better sense of how many are still dependent on unemployment insurance and could serve as an indicator of the success of the Paycheck Protection Program. With a value of nearly $3 Trillion, this stimulus relief package is set to expire on June 30th and there are several bills circulating virtual capital hill to try and bridge the next gap.

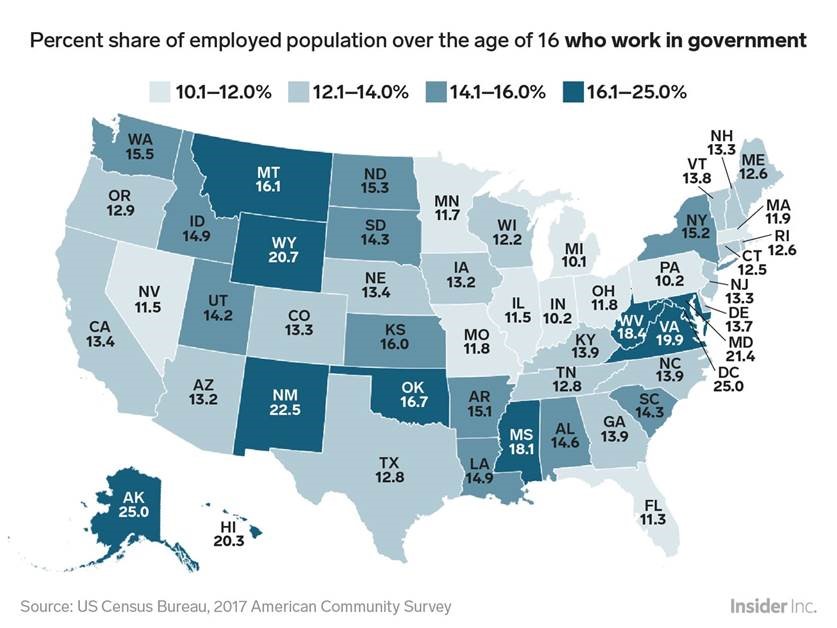

Congress is also being challenged by governors around the country to help them balance their covid-ravaged budgets and avoid layoffs. Even in Michigan, where the government’s share of employment is the lowest in the country, roughly 10% of our workforce’s paychecks can be traced back to tax dollars. Some economists are worried about two second waves, the second wave of infections as restrictions loosen, and a second wave of layoffs as unemployment benefits dry up and small and medium sized businesses and state and local governments go belly up.