“The disconnect between what the average person sees happening in the world and what they see happening in the financial markets is getting wider and wider”

-Marshall Gittler, BDSwiss

Global markets continue to rally this week, amidst ongoing civil unrest in the world’s largest economy, as the MSCI world equity index rose to its highest level since March 6th this morning as the U.S. dollar fell for the 6th day straight. Confidence grew in a recovery from the economic impacts of the coronavirus as more states and countries continued to ease lockdown restrictions and progress is made towards vaccines. This broader economic optimism has shown its face across multiple indices, as risk-sensitive currencies gain ground against the safe haven U.S. Dollar, yield curves for the U.S. and other government debt steepen, and oil prices gain ground.

This positivity in the market does not reflect what the current data being released demonstrates, but instead reflects expectations for future positive data to show face. Euro zone producer prices fell more than expected in April, by 2% for a 4.5% decline year over year. This was mostly driven by a drop in energy (oil) prices, but is being watched closely by the European Central Bank as producer prices flow into consumer prices which the ECB wants to maintain just below 2% growth YoY to avoid both deflation and hyperinflation.

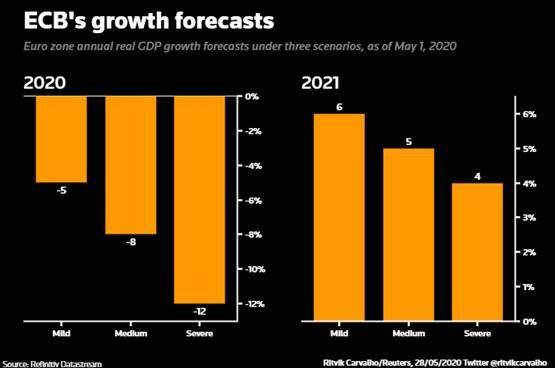

The European Commission proposed a ~$2 trillion fiscal stimulus package to help stimulate the region’s economy. Current ECB chief Christine Legarde now expects a contraction of 8-12% this year vs. a 5-12% expectation from earlier forecasts. This represents a shift away from confidence that growth will rebound quickly and there will likely be a need more monetary stimulus. The central bank meets tomorrow and markets are expecting them to increase their bond-buying program from 750 million euros to 1.25 trillion euros.

Many Americans have already received some fiscal stimulus from the government whether in the form of a stimulus check, increased unemployment insurance or business loans. As the economic recovery slowly unfolds, congress has more proposals on the table to funnel money to the citizens in an effort to spark a faster recovery. Some are weary of maintaining a balanced budget, but in a country where 70% of our GDP comes from consumer spending, its hard to argue against arming our consumers with cold hard cash to spend.

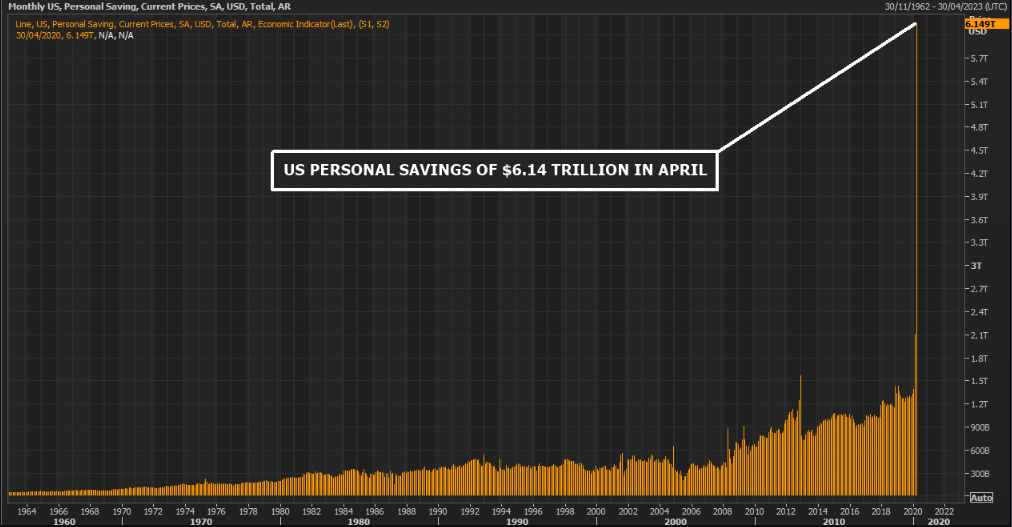

Even without the stimulus, many households in the U.S. have built up their own cash pile with fewer opportunities to go out and buy avocado toast and mimosas. As I mentioned last week, governments and businesses are digging deep to understand how the lockdown and experiences consumers have had the last few months will impact their spending habits. Economists believe that if people treat these additional savings the same way they treated tax rebates in 2001 and 2008 (which were almost fully spent after 6 months on goods like furniture and consumer electronics) we could see a surge in spending that makes a “v-shaped” recovery more realistic.