Happy FEDnesday everyone!

Our friends over at the Federal Open Market Committee will conclude their 3rd two-day meeting of 2020 today (the mid-march gathering was cancelled with 5 other unscheduled meetings taking place that month). Investors are not expecting any movement on rates as the federal funds rate (the rate at which banks can lend their reserves to each other overnight) is currently sitting in a target range of 0-0.25% and many U.S. economists have hesitated to follow central banks from Japan and the EU and their negative interest rate experiments.

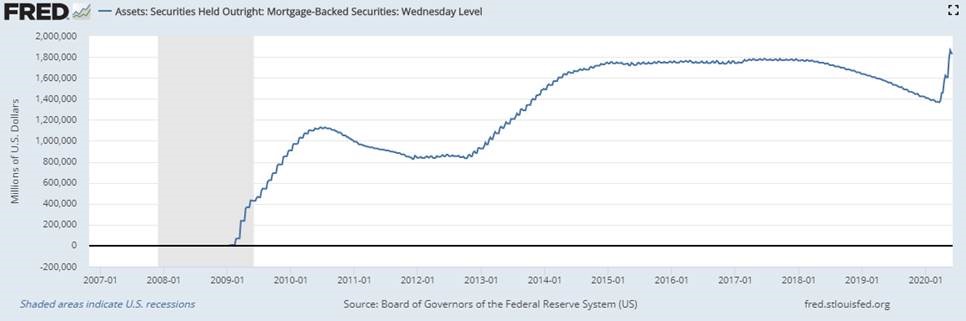

While the FED has stayed away from cutting rates any further, there is certainly no shortage of monetary stimulus coming out of Jerome Powell’s band of economists. The FED has ramped up its quantitative easing (bond-buying) program in a similar fashion to the 2008 recession, but with a broader mandate and at a more rapid pace. The FED has worked with the Treasury to begin buying corporate and municipal debt to add to its pile of U.S. treasury bonds and mortgage backed securities.

The FED has added a net of ~$280 billion of mortgage backed securities to its balance sheet over the last year bringing its total to over $1.8 trillion in MBS holdings – up ~$400 billion during this downturn.

Investors are expecting the FED to reiterate the promise it’s been repeating since it came out in March with a vow of near zero interest and provide whatever support is needed until the economy is “on track.” As normal, investors will be parsing through every word that comes out of Powell’s mouth in his press conference following the decision at 2PM to try and understand what the FED is thinking and what plans they have for the future.

A survey of 34 quantitative economists by FiveThirtyEight after last week’s Jobs report showed that participants are increasingly optimistic about the trajectory of the economic recovery when it comes to employment. The survey administrators are chalking this increased optimism to last Friday’s report that showed better than expected job gains as employers bring workers back at a faster than anticipated rate.

With states continuing to loosen restrictions, epidemiologists continue to warn of the potential impact from a second wave or peak of COVID infections and reiterate that the U.S. needs to ramp up its testing capabilities to catch up with other developed nations.

Doctors aren’t the only ones worried about the dangers of excessive optimism. Nobel Prize winning economist Paul Krugman continues to pen columns for the New York Times and this week he’s focused on ensuring people understand that although the jobs situation looked better than we thought from the data released last week, it is because of the increased unemployment insurance benefits and paycheck protection program which are both set to expire. Krugman is worried that some conservative politicians will be hesitant to extend these fiscal stimulus programs amid increased optimism which will ultimately lead to more demise for our economy, even as U.S. equities are returning to pre-crisis levels.