The first headline I read this morning was “Stocks pare gains on second wave fears” while the second read “Stocks rally on COVID recovery optimism.” – as they say in Germany, klar wie Kloßbrühe!

S&P futures show the market for U.S. equities set to open about a half a percent higher, which puts the index ~1% higher in the last 5 days. After painting a less than rosy picture for economic recovery last week in his press conference following the FOMC meeting, FED Chair Jerome Powell brought some momentum back to the equity rally this week by announcing the FED would begin purchasing up to $250 billion of corporate bond debt on Tuesday through its Secondary Market Corporate Credit Facility (SMCCF). It will also soon launch a Primary Market Corporate Credit Facility (PMCCF) to purchase debt directly from companies to the tune of up to $500 billion.

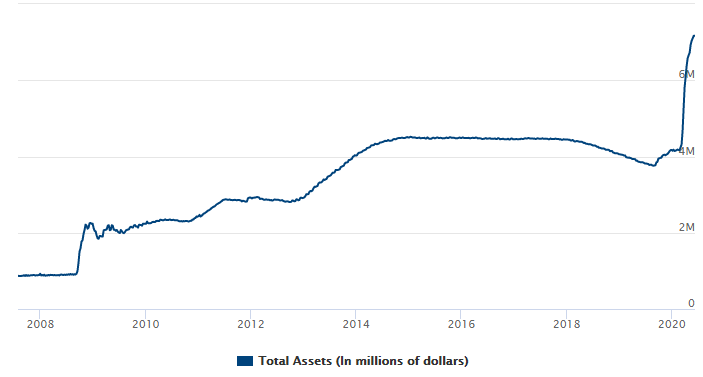

Today alone, the FED could purchase up to $4.7 billion in Mortgage-Backed Securities continuing to push its balance sheet towards $7 trillion in assets – it is this outpouring of monetary support that has enabled stocks to return to ~90% of their February highs, while also pushing mortgage rates down into the 2’s.

Total Assets of the Federal Reserve

Source – FederalReserve.Gov

Powell is back on the mic this week, this time spending a couple days on capitol hill for his bi-annual congressional testimony where some elected officials ask legitimate economic questions, and others get good photo ops for their re-election commercials. The top FED official told congress that a full U.S. economic recovery will not occur until the American people are sure that the epidemic has been brought under control. Powell said that the central bank’s current forecast shows the economy (as measured by GDP) shrinking 6.5% in 2020 (while asterisking that statement by saying the body did not assume a significant second wave of infections in that forecast)

Powell echoed a similar sentiment to previous testimony – that congress needs to step up fiscal stimulus in order to help bridge the gap through the virus. He called this a “critical difference” in avoiding long term damage. He also frequently reminded lawmakers that the FED could lend, but that Congress could spend.

Remember that German idiom I kicked off with?

It means “clear as mud.”

With all of the uncertainty on main street and wall street, central banks like the FED and the EU are encouraging their governments to spend to spur growth and keep unemployment issues at bay, and Germany’s government has answered that call. Typically, a nation focused on fiscal conservatism and heralding the “black-zero” balanced budget, Germany’s Finance Minister Olaf Scholz pushed through another supplementary budget to finance its ~$250 billion spending program.

Another stock headline this morning – “Stocks gained on a report that the Trump administration is preparing a ~$1 trillion infrastructure plan”

Sounds like they’re looking to bridge the gap!